计量经济学考试代写 Econometrics考试代写 Econometrics代写

1325Econometrics exam EXAM RULES 计量经济学考试代写 1. Exam takes 90 min. 2. This exam is a closed book exam. 3. Everybody is required to sign on the list. 4. The solution of exercise should...

View detailsSearch the whole station

财务会计期末代考 Question 2 Everest Foam Company (EFC) has developed and manufactured a foam mattress which is proven to last for 10 years.

Given the following information, what impairment exists on this Equipment?

| Equipment | |

| Original cost | $10,800,000 |

| Accumulated depreciation | 4,200,000 |

| Fair value | 7,000,000 |

| Costs to sell | 1,000,000 |

| Value in use | 6,700,000 |

Everest Foam Company (EFC) has developed and manufactured a foam mattress which is proven to last for 10 years. As part of EFC’s promotion strategy for this mattress, On April 1, 2021 they purchased the right to a song from a world-famous band for $1,000,000. Although EFC has the exclusive right to use the song forever, management’s intention is to use the song in an advertising campaign which will run for the next 2 years (April 1, 2021 thru March 31, 2023).

Assuming EFC has a December 31 year end date and there are no indications of impairment, what will the carrying amount of the rights to the song be on the December 31, 2021?

Which of the following statements about the accounting for investment property is NOT correct?

Covid Quash Ltd (CQL) is a small publicly owned pharmaceutical company that had the following transaction occur during the 2021 year end: $1,000,000 was paid to staff to further develop a vaccine that was effective in triggering an immune response against the Covid 19 virus in human trials. Market research showed a huge market for this vaccine and the Board has committed further resources to complete the development of this project and to market the injection.

The amount was initially capitalized to an account called “Research & Development costs” at the end of the year CQL wants this account closed out and the amounts either expensed or capitalized to an asset account called “Development costs – asset”. Which of the following journal entries would be required to adjust CQL’s books at year end?

In 2020, Frosty Inc. set up a new manufacturing facility in Nova Scotia. As part of a green initiative that the province has in place, the government provided Frosty with a $250,000 grant to purchase a new piece of equipment with a recognized green certification. The grant was received on December 14, 2020 and Frosty has plans to purchase the equipment in January 2021.

What journal entry would be required to record receipt of the grant in fiscal 2020, using the net method?

On January 1, 2019, a machine was purchased for $12,000. The machine was estimated to have a 8-year useful life and a residual value of $500. Assume straight-line depreciation is used. On January 1, 2021, the machine was sold for $10,000.

How much would be recorded as a gain on disposal of the machine on January 1, 2021?

Which statement is correct?

Birch Company (BC) has a March 31 year-end and has been renting its office building for several years. On April 1, 2020, it acquired land with an abandoned warehouse on it for $100,000 with the intention of constructing a new building on the property. Other costs included:

Demolition of warehouse $ 45,000

Legal fees for purchase of land 3,200

Construction costs of new building 100,000

Proceeds from salvage of warehouse materials 8,000

Installation of wiring and plumbing fixtures 19,000

Architectural fees 23,000

How much will be capitalized to “land’ in fiscal 2020?

North Pole Resources Inc. (NPRI) incurred the following costs related to three separate mine sites:

| Mine Site | Costs incurred in exploration and evaluation | Costs incurred in development | Status at year-end |

| Comet | 2,000,000 | Abandoned | |

| Cupid | 1,000,000 | 2,000,000 | In development |

| Vixen | 3,000,000 | 1,000,000 | Producing at 5% of reserves |

How much would NPRI capitalize as “intangible assets” under the full cost method?

During fiscal year 2021, Management decided to change the method of depreciation for a machine that was purchased January 1, 2020 from the double-declining balance method to the straight-line method. The depreciation expense for this machine under each of these methods for 2020 was determined to be as follows:

Assume that net income before tax (NIBT) was $105,000 for fiscal 2020, What is the appropriate adjustment type and revised NIBT value for fiscal 2020 given this accounting change?

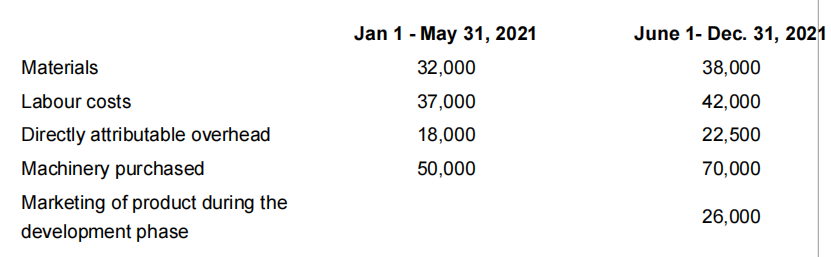

Scientia Inc. incurred the following costs in its research and development division related to the research and development of an innovative new product:

At May 31, 2021, Scientia Inc. determined that the project was technically feasible and commercially viable. Scientia Inc. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product.

Assuming Scientia Inc. is a publicly traded company, what amount will be recorded on the balance sheet for the internally generated intangible asset for fiscal 2021?

Hydro Co has 3 inventory items in stock at year end. The costs to sell are commissions of 10%. Based on the following information, determine the amount (if any) of the inventory write-down required at year end.

| Item | Cost per unit | Units | Selling price per unit | Cost to sell |

| A | $100 | 200 | $150 | $15 |

| B | $120 | 250 | $130 | $12 |

| C | $50 | 200 | $45 | $4.5 |

Which of the following are Biological assets?

In 2021, Coffee & Cream Co initially reported net income of $254,000. You have since

been made aware of the following errors in inventory:

What is Coffee & Cream’s corrected net income for 2021?

Frosty Inc wishes to use the revaluation model for this property. There have been no prior revaluation adjustments booked to date:

| Before Revaluation | |

| Building Cost | 120,000 |

| Net carrying value | 80,000 |

The fair value for the property is $100,000. What amount would be booked to the “accumulated depreciation” account if Frosty chooses to use the proportional method to record the revaluation?

Early in 2021, Forest Ltd. signed a contract to construct a warehouse. At that time, Forest’s management estimated the gross profit on the contract to be as follows:

| Contract Price | $3,500,000 |

| Estimated total costs | 2,760,000 |

| Estimated gross profit | 740,000 |

At the end of 2021, the status of the work on the contract was as follows:

| Costs incurred to date | $1,350,000 |

| Estimated costs to complete | 1,650,000 |

How much revenue can be recognized on this contract for 2021, assuming that Forest uses the percentage-of-completion basis for long-term construction contracts and the cost-to-cost approach (round to nearest dollar)?

Covid Quash Ltd (CQL) is a small publicly owned pharmaceutical company that had the following transaction occur during the 2021 year end: $1,000,000 was paid to staff to investigate whether a vaccine was effective in triggering an immune response against the Covid 19 virus in mink. Market research showed a huge market for a vaccine that could trigger an immune response to Covid 19 virus in humans as such, the Board has committed further resources to complete the development of this project and to market the vaccine.

The amount was initially capitalized to an account called “Research & Development costs” at the end of the year CQL wants this account closed out and the amounts either expensed or capitalized to an asset account called “Development costs – asset”. Which of the following journal entries would be required to adjust CQL’s books at year end?

How does Santa Claus’ accountant value his sleigh?

This is a bonus question.

Thank you for a great semester. Enjoy your time off, I hope to see you back next semester in 304.

The Inked Pen (TIP) operates a chain of stationary stores. Recent operations have been stable and profitable, leaving TIP with excess cash that they have decided to invest. During the year ended December 31, 2021, the company made the following investments:

Investment 1

On February 1, 2021, TIP purchased 60,000 shares of The Academic Planner (TAP), a supplier of calendars and journals geared toward student life planning, for $44 per share plus a transaction fee of $10,000. TAP is a publicly traded company with 1,000,000 common shares issued and outstanding.

With in-depth knowledge of the planner retail business, TIP’s management believes that TAP’s shares are currently undervalued and that the company could make a quick profit selling the shares within the next 12 months. The TAP shares paid a $0.60 per share dividend on June 30, 2021.

At the end of 2021, TAP shares were trading at $49 per share. On January 15, 2022, TIP sold all the TAP shares for proceeds of $2,820,000 less a transaction fee of $10,000.

Investment 2 财务会计期末代考

The Invested Planner (TIP) purchased 3,000 common shares of the Bank of Montreal (BMO) on March 1, 2021 at a per share price of $130 plus a transaction fee of $5,000. TIP made an irrevocable election to measure this investment at FVOCI-equity.

During fiscal 2021, TIP received a dividend of $5.60/share on the BMO shares. BMO had earnings per share of $6.30 in 2021 and the closing price per share on December 31, 2021 was $136. On January 15, 2022, TIP sold all of the BMO shares for net proceeds of $420,000.

Investment 1

1. Identify the accounting method that should be used for Investment 1.

2. Provide the journal entries required for fiscal 2021 and 2022 related to Investment 1. For all income amounts, you must specify if it is being included in Net Income or Other Comprehensive Income.

Investment 2

1. Identify the accounting method that should be used for Investment 2.

2. Provide the journal entries required for fiscal 2021 and 2022 related to Investment 2. For all income amounts, you must specify if it is being included in Net Income or Otherp 0 words Comprehensive Income.

On January 1, 2015, Candy Cane Co (CCC) purchased the machinery required for a small scale candy production line for $200,000. The candy production line is a cash generating unit, has an estimated useful life of 10 years and an estimated residual value of nil.

On December 31, 2018, it was determined that the production line was impaired and an impairment loss of $36,000 was recorded.

The value of the production line was reassessed on December 31, 2021 and the recoverable amount at that time was determined to be $90,000.

Assuming that CCC uses straight-line depreciation and takes a full year of depreciation in the year of acquisition, what is the amount of the impairment reversal recorded on December 31, 2021 under the following assumptions?

a) Assume that CCC reports under IFRS.

b) Assumes that CCC reports under ASPE

Wanderer Backpack Company (WBC) manufactures high-end backpacks and has experienced a significant decline in sales over the past year due to an increase in competition from low-cost foreign manufacturers. WBC’s backpacks are produced on an assembly line. The equipment in this assembly line has not been previously revalued or impaired. The company reports under IFRS. For the year ending December 31, 2021, the WBC’s controller gathered the following information relating to the assembly line equipment, which is considered to be a cash generating unit:

Original cost $6,397,000

Accumulated depreciation 2,400,000

Fair value 3,274,000

Sales commission 4.5%

Risk adjusted cost of capital 6%

Incremental cash flows for

2022 $1,100,000

2023 1,000,000

2024 900,000

2025 800,000

2026 and thereafter 0

Required:

1. Determine the recoverable amount for the assembly line equipment, be sure to show your calculation for all necessary components

2. Determine if an impairment exists (show your work). IF impairment exists, prepare the related journal entry.

The Letters to Santa Inc (LSI) operates a chain of stationary stores. Recent operations have been stable and profitable, leaving LSI with excess cash that they have decided to invest. During the year ended December 31, 2021, the company made the following investment:

Investment

On January 1, 2021, LSI acquired 1000, 6% bonds each with a face value of $1,000 for $1,072,217 plus a $5,000 transaction fee. The bonds were dated January 1, 2021, and mature on December 31, 2030, with interest payable at the end of each year. LSI does not record entries to accrue for interest income during the year. LSI intends to hold the bonds to maturity. Assume an effective interest rate of 5% and that both of the rates provided in the question are annual rates.

REQUIRED:

1. Identify the accounting method that should be used for this Investment.

2. Provide the journal entries required for fiscal 2021 and 2022 related to this Investment. For all income amounts, you must specify if it is being included in Net Income or Other Comprehensive Income.

Diamond Extractors Inc (DEI) is a Canadian public company with a December 31 year end. On June 30, 2017 DEI purchased drilling equipment for a total cost of $5,000,000. The equipment’s net book value at January 1, 2021 was $3,600,000. Depreciation expense for 2021 was $400,000. An appraiser determined that the fair value of the equipment as at December 31, 2021 was $4,000,000. This is the first year that the company has revalued this equipment.

REQUIRED:

1. Provide the journal entry for the revaluation adjustment assuming that DEI uses the proportional method.

2. Provide the journal entry for the revaluation adjustment assuming that DEI uses the elimination method.

3. How would your journal entry for part (i) have changed if DEI had previously reported a revaluation loss of $400,000 (you can assume the values above already incorporate the adjustment for that loss).

The Posh Pen Company (TPPC) had been renting office space for several years. On January 1, 2021, TPPC decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $700,000. Management’s intention was to demolish the existing warehouse and construct the new one in its place. Other costs incurred included the following:

Demolition of warehouse $36,000

Legal fees for purchase of land 6,600

Construction costs of new building 1,372,000

Proceeds from salvage of warehouse materials 12,000

Installation of wiring and plumbing fixtures 26,000

Architectural Design Fees 42,000

Interest costs on construction loan for the period January 1 – December 31 2021 8,000

The building was completed and occupied on October 31, 2021.

Required:

1. Calculate the amount TPPC should record for the (i) land and (ii) building. Show your calculations.

2. Assume for this part of the question that that the costs capitalized for the building totaled $2,400,000 (note: you will not be able to reconcile this amount to part 1) and the estimated useful life of the building is 40 years, with residual value of $280,000.

Calculate depreciation for 2021 and 2022 using the following methods and assuming that TPPC uses fractional year depreciation based on months:

(i) Straight-line method

(ii) Double declining balance method.

更多代写:vue代写 duolingo english test作弊 英国财务作业代写 论文格式范例 grammarly查重 毕业论文购买

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

Econometrics exam EXAM RULES 计量经济学考试代写 1. Exam takes 90 min. 2. This exam is a closed book exam. 3. Everybody is required to sign on the list. 4. The solution of exercise should...

View detailsFINANCIAL ACCOUNTING II MsC in MANAGEMET / FINANCE AND ACCOUNTING FINAL EXAM 财务会计代写 INFORMATION 1.The duration of the exam is 2 hours and 30 minutes. 2.The exam must be performed ...

View detailsCOEN 174 Software Engineering Midterm1 (50 pts) 软件工程代写 For each of the systems described in a) and b), select the most appropriate software process model from the list...

View detailsAc.F 311 FINANCIAL ACCOUNTING II 财务会计考试代考 (DURATION: 2.5 HOURS plus 30 minutes upload time) This examination paper consists of four questions, each worth 50 marks. Answer any TWO questi...

View details